owner's draw vs salary uk

Dividends paid by a company to a shareholder out of after-tax profits are taxable for that shareholder. She would also have to pay 3596 in NICs.

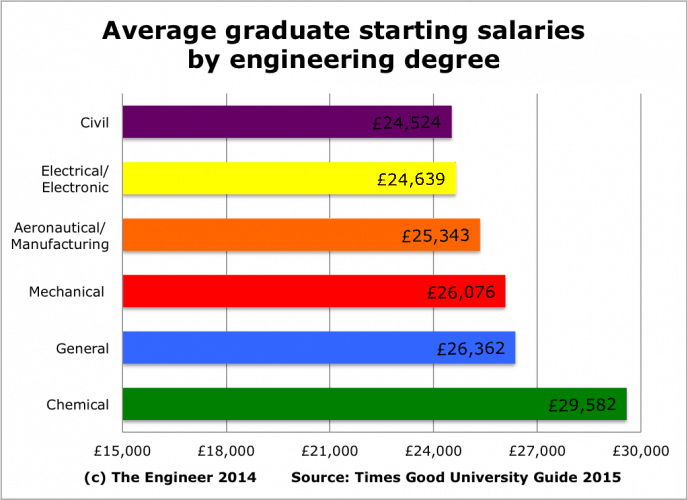

The Myth Of Engineering Low Pay

At year-end credit the Owners Drawing account to close it for the year and transfer the balance with a debit to the Owners Equity account.

. Owners draws are usually taken from your owners equity account. Salary and Bonuses. As a company owner should you pay yourself a salary or drawings.

This is called a draw. Dividends are taxed slightly differently as they are not liable for Income Tax or NICs. A sole proprietor or single-member LLC owner can draw money out of the business.

When choosing owners draw. If youre a business owner you have the option of paying yourself a salary dividends or a hybrid of the two. The reason for this is because a salary attracts a National Insurance levy.

There are upsides and downsides to both. It is an accounting transaction and it doesnt show up on the owners tax return. 64 09 358 5656.

Salaries paid are tax deductible for your company reducing its profits and taxable income and therefore the amount of company tax it pays. Via a shareholder loan which you are required to repay. So Janes income tax bill for the year will be 1807.

Heres a high-level look at the difference between a. Directors of owner-managed companies often draw low levels of salary typically between 7500 and 9500 per annum. If an individual invests 30000 into a business entity and their share of profit is 18000 then their owners equity is at 48000.

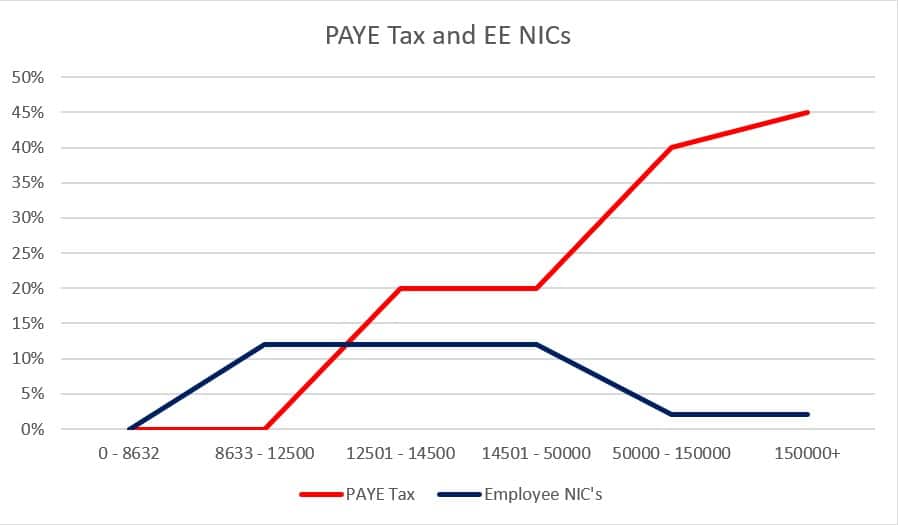

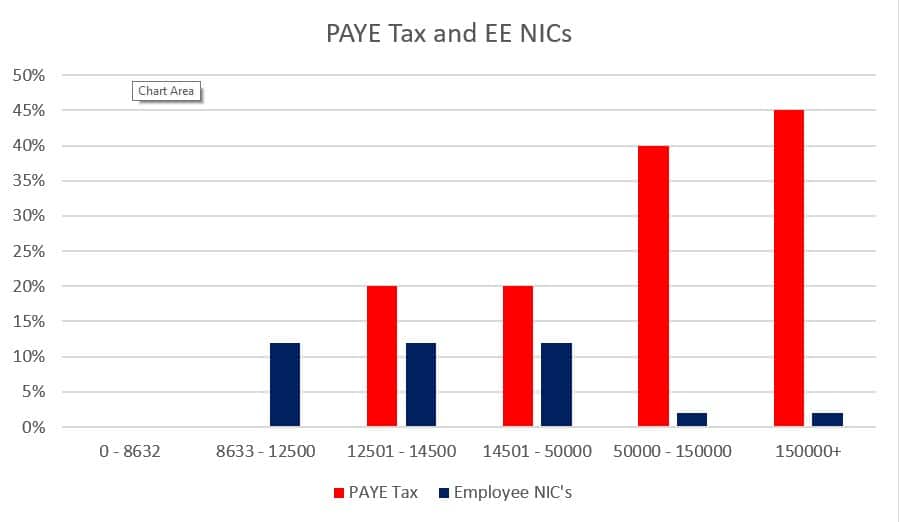

All business owners ask whether they should pay themselves a salary or drawings. An owners draw also called a draw is when a business owner takes funds out of their business for personal use. 45 on earnings above 150000.

Salary is direct compensation while a draw is a loan to be repaid out of future earnings. Business owners might use a draw for compensation versus paying themselves a salary. A partners distribution or distributive share on the other hand must be recorded using Schedule K-1 as noted above and it shows up on the owners tax return.

If the company has already paid tax and franking credits on the dividend are. The National Insurance rate for employees is 12 between 8632 and 50024 and 2 above this figure. If you draw 30000 then your owners equity goes down to 45000.

Owners equity is made up of different funds including money youve. Thats a very common question were asked and like most tax questions the answer is not cut and dried. However you choose to pay yourself depends on multiple business and personal factors.

There are two journal entries for Owners Drawing account. A draw is usually smaller than the commission potential and any excess commission over the draw payback is extra income to the employee with no limits on higher earning potential. Salary is fixed and higher earning potential comes only.

Suppose the owner draws 20000 then the owners equity is reduced to 28000. By paying yourself a salary. At the time of the distribution of funds to an owner debit the Owners Drawing account and credit the Cash in Bank account.

This 24100 is taxed at the dividend basic rate of income tax which is just 75 per cent. 20 on earnings above the threshold and up to 37700. 40 on earnings between 37701 and 150000.

If Jane had taken the whole 38600 as salary then her income tax bill would have been 20 per cent of 26100 which is 5220. Its the amount an owner invested and profits that the business made thanks to the investment. An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary.

There are pros and cons to both and we examine the issues.

Also Interesting Men Vs Women Man Vs Infographic

Pakistan Air Force Ranks And Salary

Letter Building Templates 3 Templates Example

Salary Vs Dividends Which Is Best 2020 21 Fusion Accountants

Salary Vs Dividends Which Is Best 2020 21 Fusion Accountants

A Project Report On Online Job Portal 1000 Projects Job Portal Online Jobs Job Portal Website

Business Operations Archives Leadership Girl Business Owner Business Sales And Marketing Strategy

Privacy Policy For Influencers Bloggers And Online Business Owners In 2020 Online Business Business Owner Privacy Policy

Building Construction Scope Of Work Template Google Docs Word Apple Pages Template Net

Zinger Model David Zinger Employee Engagement Speaker Employee Engagement Employee Engagement Model Engagement Quotes

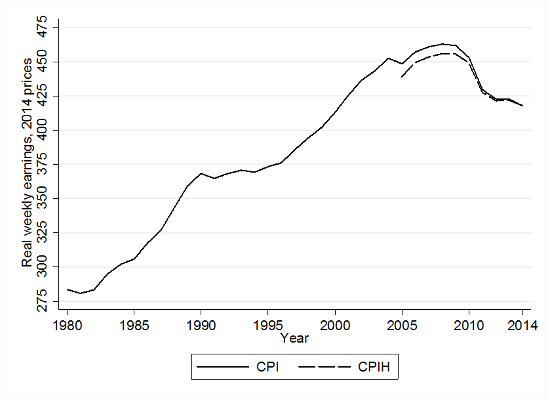

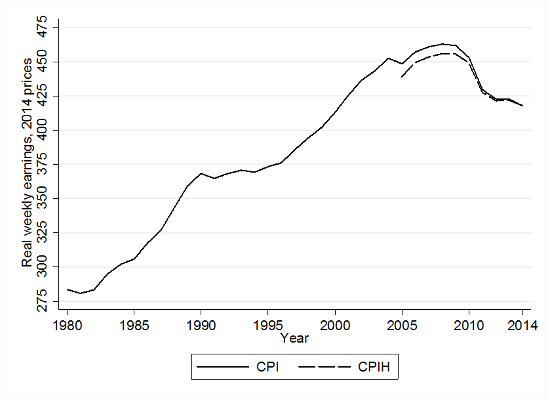

Real Wages And Living Standards The Latest Uk Evidence British Politics And Policy At Lse

Do You Know It S Important For You To Decide How To Pay Yourself As A Business Owner These Ti Personal Financial Statement Business Owner Small Business Owner

Corgi Mum Dog Keyring Mothers Day Gift Corgi Gifthand Etsy Uk

Why Are Salaries In The Uk Europe So Low Is The Cost Of Living Generally Lower Than The Us Quora

The Salary Of Consultants In The Uk Consulting Industry

Costum Internship Email Template Doc Sample Email Templates Advertising Strategies Email Marketing Strategy

Company Thinks They Can Easily Replace This Worker When He Quits After Being Denied A Raise Have