child tax credit december 2019 payment date

Your recurring monthly payments shouldve hit your bank account on the 15th of each month through December. For each child under age 6 and up to 250 per month for each child age 6 and above.

You can check eligibility requirements for stimulus.

. 15 by direct deposit and through the mail. The Child Tax Credit provides money to support American families helping them make ends meet. 1400 in March 2021.

15 to sign up for December child tax credit payments the IRS has announced. You will not receive a monthly payment if your total benefit amount for the year is less than 240. This part of the American Rescue Plan began in.

It is a partially refundable tax credit if you had an earned income of at least 2500 for 2019. The Child Tax Credit helps all families succeed. The Final Payment For 2021 Is Scheduled For December 15th.

The first half of the credit is being sent as monthly payments of up to 300 for the rest of 2021 and the second half can be claimed when parents file their income tax returns for 2021. Instead you will receive one lump sum payment with your July payment. After talking to Accounting Aid and filing her tax returns Bayn received 500 for the advance child tax credit in October and she received another 500 in.

The deadline to opt-out for the December payment is November 29th 2021. 15 and some will be for 1800 Source. 29 What happens with the child tax credit payments after December.

The fifth payment date is Wednesday December 15 with the IRS sending most of the checks via direct deposit. 15 opt out by Nov. The payments will be sent by check or direct deposit on July 15 Aug.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Payment dates for the child tax credit payment The next and last payment goes out on Dec. Payments begin July 15 and will be sent monthly through December 15 without any further action required.

Families have until Nov. 3 January - England and Northern Ireland. 15 according to a statement from the Treasury Department.

These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. Wait 5 working days from the payment date to contact us. The credit includes children who turn age 17 in 2021.

Getty Images Many taxpayers received their second-to-last round of the child tax credit. 1200 in April 2020. October 5 2022 Havent received your payment.

December 13 2022 Havent received your payment. 15 opt out by Aug. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

Monthly child tax credit payments were a godsend for many parents who struggled financially in 2021. And thats not all. 28 December - England and Scotland only.

Patrick Mansfield US. If you received your first payment in December you got up to 1800 for each child age 5. 15 opt out by Oct.

You can beneit from the credit even if you dont have earned income or dont owe any income taxes. December 15 Opt-Out Deadline. In most cases a tax credit is better than a tax deduction.

15 opt out by Nov. October 15 Opt-Out Deadline. Includes related provincial and territorial programs.

Goods and services tax harmonized sales tax GSTHST credit. It means those not receiving the payments for the first five months but who chose and qualified for the December payment may get the full first half of the credit from December 15. According to the IRS you can use the Child Tax Credit Update Portal to see your.

November 15 Opt-Out Deadline. 13 opt out by Aug. 600 in December 2020January 2021.

Please Click Here To Visit The IRS Advance Child Tax Credit Portal. For most families the agency relies on bank account information provided through. A credit directly reduces your tax bill.

If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2020 in 2017 and earlier Tax Years the credit amount was 1000. Update On Decembers Child Tax Credit Payment. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit.

Decembers child tax credit is scheduled to hit bank accounts on Dec.

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com

Health Insurance Sec 80d Tax Deduction Fy 2020 21 Ay 2021 22 Income Tax Tax Forms Tax Deductions

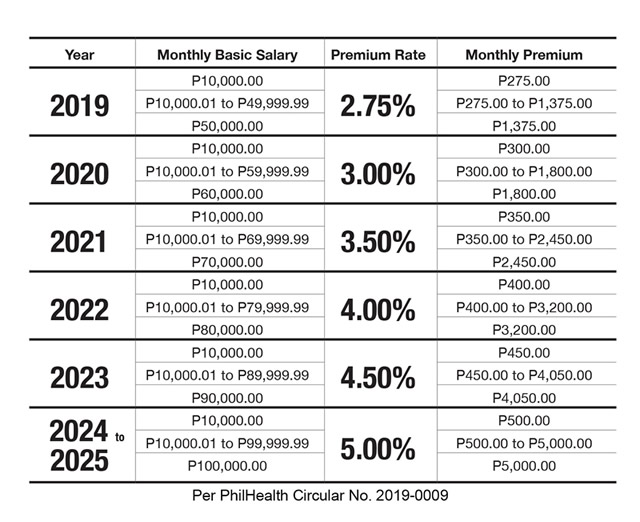

Philhealth Sets New Contribution Schedule Assures Immediate Eligibility To Benefits Philhealth

Check Out The List Of All The Important Due Dates With Respect To Gst And Tds For The Month Of February 2 Indirect Tax Goods And Service Tax Important Dates

Child Tax Credit 2021 8 Things You Need To Know District Capital

Due Date Of Income Tax Returns Itrs For Fy 2019 20 Extended Tax Return Income Tax Return Income Tax

Tds Due Dates Due Date Make It Simple Generation

Gstr 9 Due Date Annual Return For Fy 2020 21 Due Date Dating Latest News

Updates On 38th Gst Council Meeting Gstr 9 Meeting Council Financial Information

The Fastest Ways To Build Credit Infographic Ways To Build Credit Build Credit Credit Card Debt Calculator

B2b Businesses Are Exempted From Using Rupay Bhim Upi For Accepting Payments Business Taxact Finance

Gst News Updates And Compliance Calendar Available At Vsctaxsol Com Community Business Law Making Business Owner